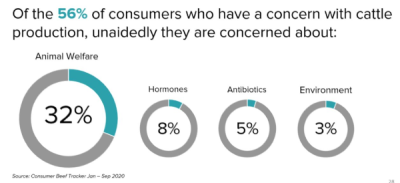

When it comes to making a meal decision, many factors are top of mind for consumers. For example, most consumers are thinking about taste, convenience, value, safety and even health—but how many are truly concerned about beef production? Of those consumers with concerns about cattle production, 32% are concerned about animal welfare.1 While this is not near the levels of the previously mentioned factors, it is a number that has grown since 2018 and is worth investigating.1

Using the Consumer Beef Tracker, a continuous online survey run by National Cattlemen’s Beef Association, on behalf of the Beef Checkoff, shows most consumers trust in many aspects related to raising cattle and the beef industry overall. However, some people are unsure. This is likely due to the low level of knowledge that consumers have related to cattle production. Consumers are further away from their food than ever before. In fact, only 27% of consumers report that they are familiar with how cattle are raised.1 Yet, 70% of consumers consider how their food was raised or grown when making meal decisions.1 This poses a problem as consumers care about the topic, but don’t understand it.

As a result, NCBA conducted extensive research with consumers, utilizing qualitative and quantitative approaches, to better understand consumer perceptions regarding cattle production. The research also evaluated the potential of making the Beef Quality Assurance (BQA) program consumer facing. The hypothesis was that orienting this program towards consumers could provide a means to educate and alleviate concerns with cattle production.

The research started with the qualitative phase. Using focus groups, the objective was to understand what consumers knew to be true about cattle and what positive or negative perceptions they had before determining reactions to BQA. The focus groups consisted of 9 different groups of 4 consumers, across 3 U.S. cities from the west coast to the east coast. The quantitative method leveraged an online survey of a national representative sample of 1,003 consumers. The objective of this phase was to validate results from the qualitative portion. Consumers who responded to the survey either had to eat beef or were not currently avoiding it (i.e. were not vegetarians).

Discussions with consumers started high-level about food production before diving into beef. What was immediately apparent was how little consumers knew. Even recruiting consumers who claimed to be knowledgeable or interested in the topic of food production, most struggled to elaborate. When directly asked how cattle are raised, there was silence in the rooms. The results were similar when asking consumers in the online survey:

“I have no idea about the beef life cycle.”

“I really have no clue whatsoever what goes into the life cycle [of cattle]”

“I really have no clue whatsoever what goes into the life cycle [of cattle]”

– Direct consumer quotes

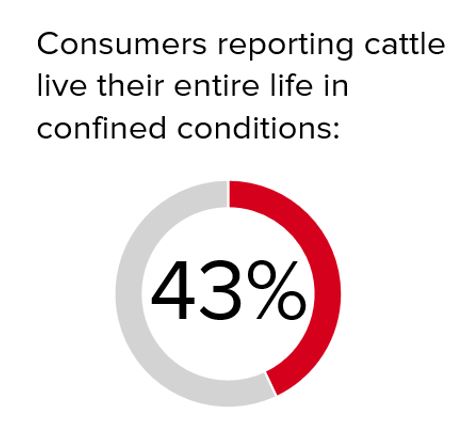

Most concerning were the misconceptions for how cattle are produced when consumers did have something to say. Though most consumers were unable to describe the life cycle of cattle, those who did were quick to highlight that cattle live in crowded conditions or mention how cattle were generally mistreated. Some examples:

“Cattle are raised quickly and fed cheaply. They're pumped with hormones and antibiotics that transfer to the meat we eat when they're slaughtered.”

“Birth, separation, shots/exam, fattened in crowded conditions, divided for type of sale, slaughtered, package, store?”

“Birth, separation, shots/exam, fattened in crowded conditions, divided for type of sale, slaughtered, package, store?”

– Direct consumer quotes

These misconceptions were further validated when consumers were provided with an aided list of potential life cycles for cattle and 43% of them chose options that included cattle living in confinement all their lives. But aside from a low knowledge level, consumers still had warranted concerns specific to cattle production. Top of mind concerns that came up in focus groups included animal treatment, what cattle eat, and hormone and antibiotic use.

For many, the misperceptions lead to two notions for how beef is produced. One idea is that beef comes from mass produced, large, corporate farms. The belief is these companies only focus on money and they are the ones responsible for inhumane treatment and overcrowded conditions. Consumers felt this is where most conventional beef comes from. The second notion is the small, family farm. Many believe this is a dying branch, but the ones that do exist have better practices, better conditions, and lead to higher quality beef. They also associate beef that is organic and grass-fed with these operations. Obviously, this is not the case. While it may not seem like it on the surface, an underlying benefit to this realization is that the industry has a tremendous opportunity to educate on this topic. Most, if not all cattle farms and ranches, are producing beef the way consumers want to envision them being produced. It is simply a matter of continuing to educate and promote this information to make consumers aware of this fact.

While these findings are significant, it is important to keep them in perspective. During the online survey we asked consumers how much of an impact the living conditions, overall treatment, and even what cattle are fed, had on their beef purchase behavior. The majority of consumers did not indicate those factors were driving their overall buying decision. In fact, even in this production related conversation, attributes such as quality, taste, and price still drove purchase behavior over production related worries.

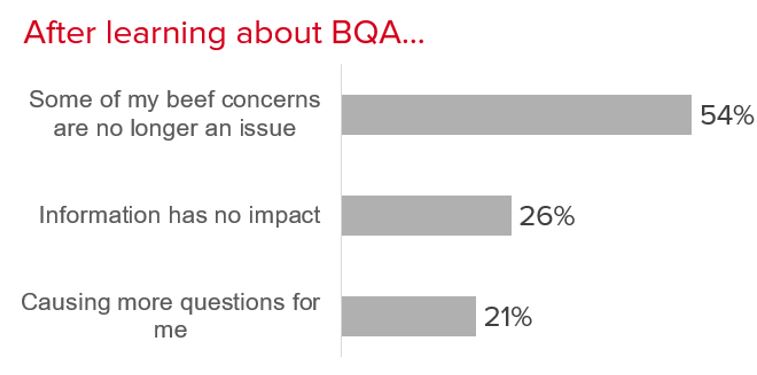

After understanding consumer’s general perceptions and mindset regarding cattle production, both the focus groups and online survey gained more feedback about the BQA program using the BQA program description, facts, and videos. Consumers initial reactions in the focus groups were positive and favorable towards the BQA program. In particular, consumers liked:

- This is a voluntary program for beef farmers and ranchers

- The program focuses on animal treatment and antibiotic guidelines

- That the program also ultimately improves the quality of beef

For many, learning about the program’s existence was enough to ease concerns. For others, learning about the program led to more questions, but consumers claimed these questions would likely be solved with an option to learn more, such as through the BQA website.

In general, knowing about the BQA program adds a layer of confidence among consumers. After learning about the program, 70% agreed it increased their confidence in the beef they eat is safe, 67% agreed that it increased their confidence that cattle are humanely raised, and 62% agreed that beef under the BQA program represents most of the beef at their grocery store.2 NCBA, on behalf of the Beef Checkoff, is always looking at ways to have content or programs that can represent the entire industry. To be able to have a program that consumers feel represents the beef they personally buy, is a big win for the industry.

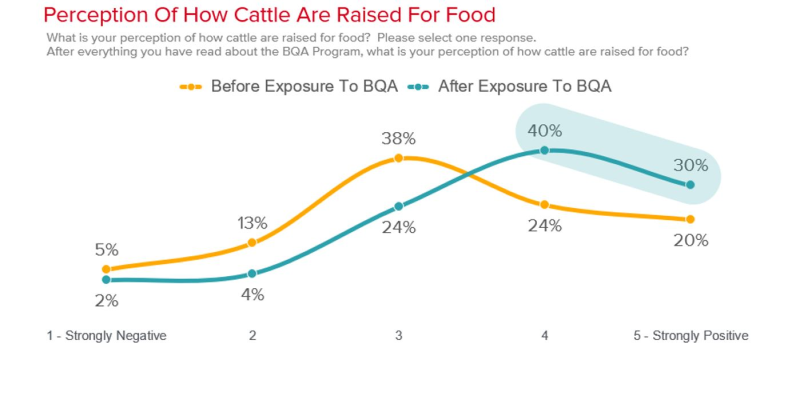

Last, one of the most significant outcomes of learning about BQA for consumers, was the impact it had on perceptions of how cattle are raised. Prior to learning about the program 44% had positive perceptions about cattle production, after—70% had positive perceptions.2

Based off this research, it is clear consumers lack an understanding of how cattle are raised, but that BQA provides ample opportunity to educate them on this topic. However, it is important to find the right balance of information depending on the type of consumer. Not only does BQA help inform consumers, but it also impacts how they feel about beef overall, which in turn makes it easier for them to choose beef.

References

- National Cattlemen’s Beef Association, Consumer Beef Tracker, 2019

- National Cattlemen’s Beef Association, Responsible Beef Exploration, 2018-2019